A good year end analysis from Scott at Boston.com.

Boston sees condo prices, sales jump

From Back Bay and Beacon Hill to Dorchester and Southie, doube-digit price increases have been seen in several Boston neighborhoods.

Boston’s red hot condo market is closing out the year with a bang, posting double-digit increases in prices and sales, the latest stats show.

The median condo price in Suffolk County, made up mostly of Boston, hit $580,000 in November after a 34 percent jump, finds real estate publisher and data firm, The Warren Group. Condo sales jumped 43 percent.

By contrast, the median home price in Boston and fellow Suffolk County communities of Chelsea, Winthrop and Revere, weighed in at $406,500 after a 3 percent increase.

Downtown Boston, including the South End, Back Bay, and Beacon Hill, led the condo price charge, with a 24 percent increase that pushed the median price to $974,000.

Jamaica Plain and South Boston both saw significant gains in condo prices in November, with prices year to date up nearly 11 percent ($445,000) in J.P. and 12 percent ($557,000) in Southie.

Dorchester and East Boston, which have been hubs of activity for new development as buyers get priced out of other neighborhoods like J.P. and the South End, also saw big gains.

Year-to-date through November, Dorchester’s median condo price has gone up 17 percent, to $344,060, while the median price of an Eastie condo rose 14 percent to $342,750.

Meanwhile, statewide, sales and prices of both condos and homes posted gains in November, posting significant gains with help from a relatively mild fall that helped keep buyers on the hunt and sellers in the game.

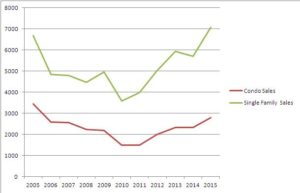

Sales of single-family homes across Massachusetts rose 8 percent, to 3,915 in November, reports the Massachusetts Association of Realtors (MAR).

The state’s median home price rose 4.5 percent to $330,000.

Condo sales rose 5 percent, while the median price of a condo posted a 10 percent increase, to $304,000.

“While most people in Massachusetts were focused on raking, getting ready for Thanksgiving and shopping in November, homebuyers stayed focused and once again push closed home sales up,” said 2015 MAR president Corinne Fitzgerald, broker-owner of FITZGERALD Real Estate in Greenfield, in a press release.