According to the latest quarterly report by the National Association of Realtors, growth in metropolitan area median home prices increased in the third quarter, and more areas are showing gains. The median existing single-family home price rose in 120 out of 149 metropolitan statistical areas (MSAs) based on closings in the third quarter compared with same quarter in 2011, while 29 areas had price declines, up from 110 areas with annual improvement in the second quarter. In the third quarter of 2011, only 39 metros improved, marking stronger home increases.

Dr. Lawrence Yun, NAR’s Chief Economist, said in a statement, “Housing inventories have been gradually trending down from a record set in the summer of 2007,” he said. “Earlier this year, a broad equilibrium began to develop in most areas between home buyers and sellers, which led to a sustained upturn in home prices. We expect fairly normal appreciation patterns in 2013, but there is a risk of price acceleration if builders are unable to increase supply to meet the needs of our growing population and household formation.”

The national median existing single-family home price was $186,100 in the third quarter, up 7.6 percent from $173,000 in the third quarter of 2011, which is the strongest year-over-year price increase since the first quarter of 2006 when the median price rose 9.4 percent. In the second quarter the price increased 7.2 percent from a year earlier.

The median price is where half of the homes sold for more and half sold for less; medians are more typical than average prices, which are skewed higher by a relatively small share of upper-end transactions.

Some of the price gain resulted from a smaller share of distressed home sales in the market, but the higher prices significantly reflect a market recovery. Distressed homes accounted for 23 percent of second quarter sales, down from 30 percent a year ago.

A separate breakout of income requirements to buy a home on a metro area basis shows buyers in the vast majority of areas had ample income in the third quarter, assuming they could meet stringent mortgage credit standards.

Total existing home sales rose 3.2 percent

Total existing-home sales rose 3.2 percent to 4.68 million in the third quarter from 4.54 million in the second quarter, and were 10.3 percent higher than the 4.25 million pace during the third quarter of 2011. At the end of the third quarter, 2.32 million existing homes were available for sale, which is 20.0 percent below the close of the third quarter of 2011 when 2.90 million homes were on the market.

According to Freddie Mac, the national commitment rate on a 30-year conventional fixed-rate mortgage averaged a record low 3.54 percent in the third quarter, down from 3.80 percent in the second quarter and 4.31 percent in the third quarter of 2011.

NAR President Moe Veissi said affordability conditions are a big factor in rising sales. “Historically low mortgage interest rates are encouraging many buyers who were on the sidelines,” he said. “Sales this year are notably higher than the levels seen in 2008 through 2011, so we’re clearly in a recovery phase with rising sales, declining inventory and rising prices. Of course the recovery would be stronger and more stable if we could return to safe but sensible mortgage underwriting standards.”

First time buyers.

First-time buyers purchased 32 percent of all homes in the third quarter, down from 34 percent in the second quarter; they were 32 percent in the third quarter of 2011.

The share of all-cash home purchases was 27 percent in the third quarter, down from 29 percent in the second quarter and 29 percent in the third quarter of 2011. Investors, who make up the bulk of cash purchasers and compete with first-time buyers, accounted for 17 percent of all transactions in the third quarter, down from 19 percent in the second quarter and 20 percent a year ago.

“The modest decline in first-time buyers and investors shows the impact of limited inventory in the lower price ranges from a shrinking share of distressed homes, which are popular with both of these groups,” Yun explained.

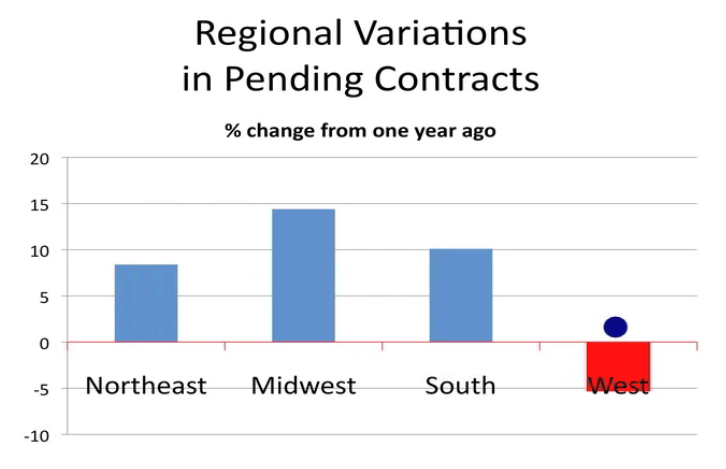

Regional performance varied

Regionally, existing-home sales in the Northeast increased 1.7 percent in the third quarter and are 9.8 percent above the third quarter of 2011. The median existing single-family home price in the Northeast slipped 0.3 percent to $246,900 in the third quarter from a year ago.

In the Midwest, existing-home sales rose 5.2 percent in the third quarter and are 17.8 percent higher than a year ago. The median existing single-family home price in the Midwest increased 4.2 percent to $151,100 in the third quarter from the same quarter in 2011.

Existing-home sales in the South increased 5.4 percent in the third quarter and are 11.7 percent above the third quarter of 2011. The regional median existing single-family home price rose 5.7 percent to $165,400 in the third quarter from a year earlier.

In the West, existing-home sales slipped 1.2 percent in the third quarter due to limited supplies, but are 2.1 percent higher than a year ago. With the tight inventory, the median existing single-family home price in the West surged 20.2 percent to $247,400 in the third quarter from the third quarter of 2011.