Tag: downtown Boston real estate

Boston’s Best New Building?

Great post from Curbed.com. Don’t you just love John Keiths comments on The Troy? Enjoy!

What Was Greater Boston’s Best New Building of 2014?

[315 on A]

Paul McMorrow, Boston Globe op-ed columnist and CommonWealth magazine associate editor: There are so many! The Burnham building on the Filene’s block is obviously the best thing to happen downtown in forever. Sasaki’s Ferdinand building looks incredible and it’s getting private developers to take a look at a neighborhood they’ve been ignoring for decades. ADD Inc.’s 315 A Street manages the neat trick of being on the waterfront without looking like a glass box that snuck in from Houston. The Lawn on D is not technically a building, but it has swings and ping-pong tables and Wi-Fi so it wins everything.

__

Lara Gordon, a broker in Cambridge and Somerville: Could it be anything OTHER THAN Millennium Place? Speaking not from an architectural or design perspective, but purely for its contribution to the Downtown Crossing renaissance.

__

[Troy Boston]

John A. Keith, a Boston broker: I’d have to go with the Troy, ready for occupancy in early 2015, purely for the huge balls the developer must have, building a 400-unit apartment building across the street from New England’s largest homeless shelter (and a Mobil station) and, literally, in the shadow of an eight-lane interstate highway. I also like the new 100 Pier 4 apartment building in the SBW Seaport neighborhood, also to be delivered (late) 1st Quarter 2015. Perhaps a step up from the existing Waterside Place down the street, 100 Pier 4 is the first building to be completed in the Pier 4 mixed-use development. It has the best views of the new residential buildings in the neighborhood and is the closest (so far) to downtown Boston. Of course, neither of these were completed in 2014, so may not qualify as “Best of 2014”.

__

Charles Cherney, a broker in Cambridge and Somerville: If only there were new condo buildings in Cambridge and Somerville.

__

Jonathan Berk, real estate attorney, founder of the BuildingBOS blog and member of Boston’s Onein3 Council: My wink goes to Ink; Ink Block by National Development: Ink Block will be opening in the coming few days and will serve not only as it’s own self contained live, play environment but will also spur growth and redevelopment of the Harrison Ave and Washington Street corridors. It will provide the South End the necessary connection between Downtown, South Boston and the South End. Game-changing retail activation (Including a 50,000SF Whole Foods) coupled with a pool, outdoor BBQ’s, grass courtyard will make Ink a catalyst for necessary neighborhood reinvestment and a destination unto itself.

__

[Millennium Tower on the Boston skyline; Handel Architects]

Nick Warren, president and CEO of Warren Residential: Millennium Tower … by far. I don’t know if it officially qualifies for 2014 since it currently only has a few floors of concrete and rebar’ but it’s certainly the most exciting. There has never been a building in Boston that has received so much buzz and attention like Millennium Tower has. From their $37.5M PH to the amount of units they put under agreement right out of the gate, it truly stands out against its competition.

__

David Bates, a Boston broker and our Bates By the Numbers columnist: 315 on A – the building located in a cool area that is getting cooler. It’s green and sustainable construction. The developers put a lot of thought into the features and amenities, like the best bike storage room in the city, the indoor pet refuse area, the conference rooms, the on-site art. Plus, the rooftop common area is among the best amenities I have seen.

Very good post by Tom at curbedboston.com.

What to Watch This Fall in Greater Boston Real Estate

by Tom Acitelli

[Rendering from Pei Cobb Freed/Cambridge 7 Associates via the Globe]

‘Tis the unofficial start of autumn/fall this week with the passing of Labor Day, so we thought we’d dive into which trends and events in Greater Boston Real Estate Land are worth your attention in the next few months (they’re certainly things we’ll be following). Will Boston see its first $20M condo sale? Will Everett get a casino-resort? Will Revere? Can anything bring Hub apartment rents down? Come along, now, let’s get interested.

The Great Luxury Apartment Pivot

This is a phenomenon already under way and it could really pick up steam this fall: the conversion of under-construction or planned luxury apartment complexes into luxury condos. There are two big reasons for this: a dearth of available condos, especially in downtown Boston (more on this in a bit); and too many new luxury apartments going up, especially in downtown Boston (more on this, too, in a bit). Higher demand in a red-hot condo market also makes this move deliciously appealing.

Up, Up and Away Go Condo Prices

Condo sales prices throughout the region have been scaling up for many months now. Take downtown Boston (please… no, seriously…). It’s entirely likely that as you read this that area’s average condo price is $1,000,000 or more. Limited supply + seemingly insatiable demand + maddening opposition to new development + historically low (for now) mortgage rates = sellers asking, and getting, more and more—a trend sure to continue this fall.

And the Rents Came Tumbling Down (Sort Of)

We called a luxury apartment glut a while ago and it looks like it’s here. Newer developments are starting to offer mad-crazy incentives to lure tenants (two free months?!) and others are taking their sweet time leasing up. Add to this surplus of supply a greater number of vacancies in general and you’ve got the seeds of gradually lower rents, particularly at the higher-end. We think this fall will mark the end, at least for a while, of $3,000-a-month studios. It was a helluva run.

Mass. Rolls the Dice on Everett or Revere

Mark your calendars: Friday, Sept. 12. That is when the state gaming commission is set to designate either Everett or Revere as host city of eastern Massachusetts’ casino-resort. Yes, it seems like the wrangling has been going on forever (and it has: Massachusetts has already taken longer than any other state on its casino licensing, according to The New York Times); but the deadline for a decision is clearly in sight this fall. But! So is another deadline of sorts: Election Day on Nov. 4, when voters will have a chance to repeal the 2011 law O.K.’ing casinos.

The March Toward Boston’s First $20M Condo Begins

Construction on the massive pair of towers (massive for Boston, at least) at the Christian Science Plaza is likely to start this fall. The taller of the two towers will be quite swanky, with condos and hotel rooms managed by the Four Seasons brand (the tower’s rendered above, to the left of the Pru). Speculation has already started as to whether this699-foot spire, destined to be the tallest residential one in Boston, will host the city’s first-ever $20,000,000 condo deal. Allow us to add to the speculation: Yes, or the tower going atop Copley Place will.

As always, dear reader, stay tuned.

Summer Sizzle

Good post from Scott.

More Sellers Make Summer Sizzle

Summer is typically a sleepy time for the real estate market, but not this year.

“For sale” signs are popping up across Greater Boston and other parts of the state, with a significant uptick in homes hitting the market, says Peter Ruffini, president of the Massachusetts Association of Realtors.

That, in turn, is likely to mean good news for home buyers stressed over rising prices, Ruffini says.

Certain communities, like Plymouth, seen above, are particularly seeing a pick-up in listings.

Several dozen additional homes have hit the market in Plymouth this summer, providing a significant boost to the market, notes Ruffini, a regional vice president at Jack Conway & Co. in Hanover.

That’s significant given the coastal town is often a bellwether for the South Shore real estate market, he says.

“The good news is that there are fewer (sellers) sitting on the sidelines than there were earlier this year,” Ruffini says.

Overall, June saw 8,418 homes hit the market across the state, a 13 percent jump over the same period in 2013, MAR numbers show.

More listings, in turn, could also take some of the pressure off buyers, who are too often faced with bidding wars given the long-standing shortage of homes on the market, he says.

And while the median home price in Massachusetts hasn’t quite caught up to where it was during the housing bubble years in the mid-2000s, Ruffini is OK with that.

“In my view the market recovery is more about sustainability and affordability,” Ruffini says. “It has to be a sustainable market.”

Cheers to that.

WSJ Calls A Sellers Market

Below is Nick Timiraos’s article in the Wall Street Journal. We are certainly seeing different degrees of this dynamic in our local markets.

Housing: It’s Becoming a Seller’s Market

- National Association of Realtors

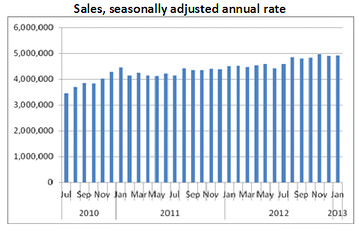

The National Association of Realtors said on Thursday what home buyers in many parts of the United States have known for months: it’s becoming a seller’s market.

The number of homes listed for sale in January fell by 4.9%, leaving 1.74 million properties on the market. That’s the lowest since December of 1999, when there were 1.71 million homes on the market. By contrast, there were 2.91 million homes on the market two years ago at this time.

After adjusting for seasonal factors, home sales rose by just 0.4% in January, to an annual rate of 4.92 million units. Still, that’s up from 9.1% one year ago.

The upshot is that there’s a growing pool of buyers chasing a shrinking supply of homes. If the trend holds, prices will keep going up. At the current pace of sales, it would take just 4.2 months to sell the current supply of homes available for sale, down from a 6.2 months’ supply one year ago.

While inventories typically increase in the spring, the Realtors’ group has expressed growing concerns that sales volumes are being held back by the lack of choice. This is good news for homeowners who have watched home prices drop over the last six years, but it’s bad news for buyers—and for anyone that makes their living selling real estate.

Inventory declines have been the most dramatic in California, Arizona, and other markets that witnessed some of the largest home price declines. Those cities have large numbers of underwater borrowers—people who owe more than their homes are worth—while many others may have equity but aren’t willing to sell because prices have fallen so far.

Investors have also been aggressive in buying up properties that are selling for less than their replacement cost.

- National Association of Realtors

Home sales could rise to 5.2 million units this year, an increase of nearly 12% from last year, according to economists atGoldman Sachs GS +2.13%. They base their forecast on household formation and demographics, which both suggest rising demand for housing in the coming years, and affordability measures such as mortgage rates and home prices.

But the economists note that there’s a considerable amount of uncertainty that could make those targets hard to hit, particularly if there’s nothing for would-be buyers to purchase.

Follow Nick @NickTimiraos

Lack of Inventory remains the challenge.

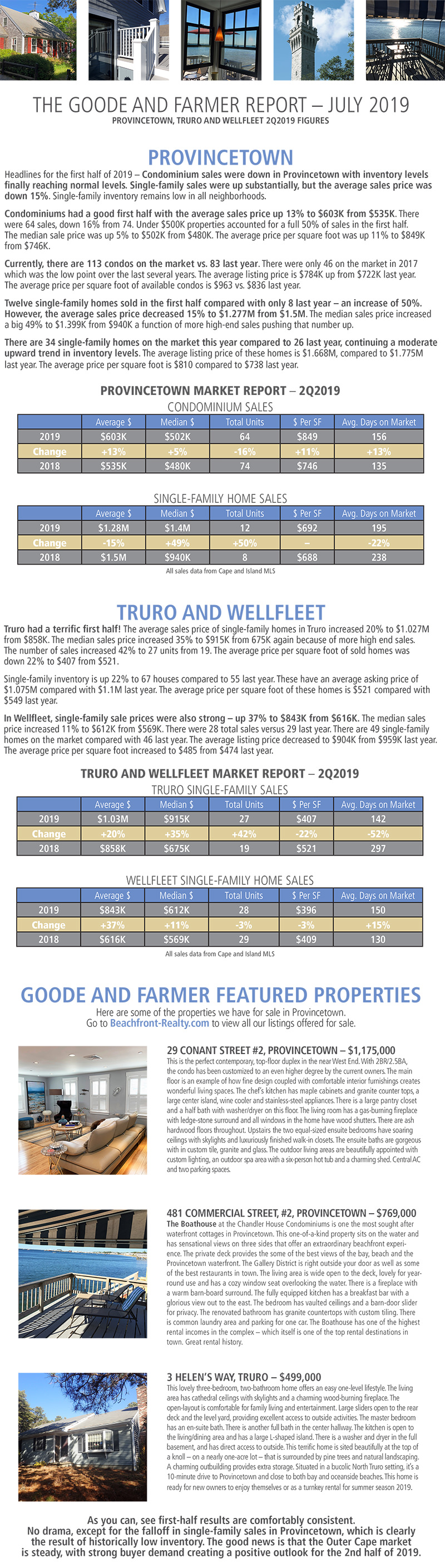

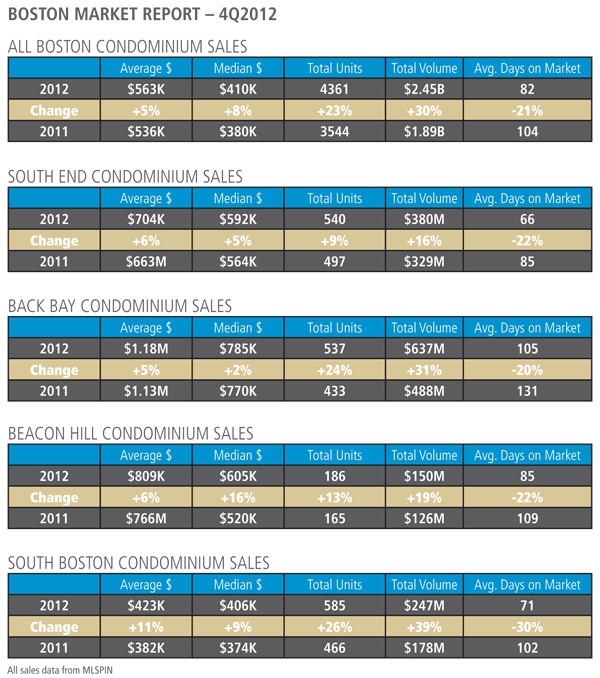

The Big Number is 23%. Combined, all Boston neighborhoods saw a 23% increase in the number of condo sold in 2012, from 3,544 sales in 2011 to 4,361 sales in 2012. The average sales price of condominiums increased 5% to $563K from $536K in 2011. The median sales price increased 8% to $410K from $380K in 2011. This real estate market is healthy except for the continuing decrease in inventory levels. The number of condominiums for sale in downtown has dropped 46% to 565 from 1050 last year at this time, and that was an extremely low number!

The Back Bay, saw a 24% increase in sales to 537 units from 433 in 2011, while the average price of a condo sold increased by 5% to $1.18M. The number of condos available for sale dropped 49% from 158 last year to only 80 today.

The South End saw a 9% increase in the number of condo sales to 540 condos sold year to date compared to 497 last year. The average price of a condo sold increased 6% to $704K compared with $663K last year. The inventory of condos for sale decreased 30% from a very low 91 last year to a terrifying 64 today. The dearth of inventory is the issue going forward.

South Boston saw a 26% increase in the number of condo sold to 585 in 2012 compared with 466 in 2011. The average sales price of a condo increased by 11% to $423K compared with $382K in 2011. South Boston has the largest drop in inventory of all downtown n’hoods down 72% from 141 properties for sale on this date last year compared to 39 available for sale today.

Inventory remains the problem, but as I have said repeatedly this market is so resilient and so desirable that declining inventory levels have not negatively effected the steady increase in sales and prices. Time will tell if this dynamic continues.

A repost of Jennifer McKim’s article in the Boston Globe follows. It shows significant evidence that we are in a real estate recovery even in the broader Massachusetts market. We have been experiencing The Recovery in downtown Boston and on the outer Cape for months now, but this broader evidence is very welcome news as we enter the NewYear.

The pullquote below from the article states what we are hearing all aross the country. Good news especially as we deal with the ramifications of the possible Fiscal Cliff.

“It feels like a housing market that has now switched into the mode of helping drive a recovery,

The Boston Globe/December 28, 2012/Jennifer McKim GLOBE STAff

- Analysts say prices remained stable, while the number of singlefamily units sold rose steeply

- A surge in home sales in November and strengthening property values are adding to a growing sentiment in the real estate industry that 2012 will mark when the housing market in Massachusetts officially began its recovery.

SOURCE: The Warren Group

JAMES ABUNDIS/GLOBE STAFF With the supply of available properties still thin, homes are selling quickly and prices are edging up, prompting real estate specialists to predict that the days of bargain prices for residences are likely to be over soon.

“This year marks the shift in housing,” said John Ranco of Hammond Residential Real Estate in South Boston. “Over the next couple of years we will start to see prices heat up a little bit.”

Last month, 4,539 single-family properties traded owners — the best November for sales since the market peak in 2005, the Warren Group, a Boston company that tracks local real estate, reported Thursday.

The number of single-family home sales through the first 11 months of 2012 exceeded that of all of last year, and the year will probably be the strongest since 2006.

Through the first 11 months of the year, home prices were about where they were for 2011 — at a median price of $288,000 — a trend that industry officials said represents a stabilized market.

In the more active market in Greater Boston, median prices were 1.1 percent above where they were in 2011, at $456,500 for single-family properties, according to the Greater Boston Association of Realtors. It’s been seven years since the housing market in Massachusetts first showed signs of slowing, and during the steepest period of the downturn values plunged 20 percent, the S&P/Case-Shiller Home Price Indices show. Prices have since rebounded modestly, though values have also bounced during the past three years.

But now, prices appear to be on the upswing — with Boston area home values up 1.6 percent in October, compared with the same month in 2011, according to Case-Shiller, which measures repeat sales and is largely considered the best marker of the housing industry.

“It is clear that the housing recovery is gaining strength,’’ said David M. Blitzer, chairman of the index committee at S&P Dow Jones Indices.

This good news comes despite uncertainty over the socalled fiscal cliff and possible changes in the mortgage interest deduction, which provides thousands of dollars in annual savings to many mortgage holders.

There are still many unknowns that could turn the market around.

However, Eric Belsky, managing director of Harvard University’s Joint Center for Housing Studies, said he foresees a strong spring season, propelled by tight inventory and low mortgage rates. He also expects markets outside of Boston to strengthen.

“It feels like a housing market that has now switched into the mode of helping drive a recovery,” Belsky said.

Meanwhile, the condo market appears to be even stronger. The number of condos sold in November, 1,635, was 33 percent above the number a year earlier, according to the Warren Group. Year-to-date condo sales rose 27 percent, compared with a year earlier.

Prices are up, too. The median condo sales price was $275,000 in November, more than 7 percent higher than a year earlier.

Warren Group chief executive Timothy M. Warren Jr. said the condo market is thriving because young people and baby boomers are increasingly interested in living in the city, with all its amenities. “Urban living is gaining ground,” he said.

Both condos and single-family homes are selling faster this year, too. And so the supply of available properties is tightening: The number of single-family homes on the market last month was 25.9 percent fewer than in November 2011, with similar declines in the condo market.

Mary O’ Donaghue, president of the the Northeast Association of Realtors, said she expects that improving consumer confidence, low interest rates, and tight inventory will keep housing moving in the spring.

“We are entering a spring market with close to ideal conditions,” she said.

Great article in the WSJ. Nick Timiraos does a great job in putting things in perspective.

By Nick Timiraos of The Wall Street Journal

In each of the last three years, home prices have increased in the spring and summer, when more people are buying homes, before giving back all of those gains and then some in the fall and winter, when activity cools.

But it is beginning to look like that might not happen this year, absent a major stumble for the economy.

Home prices in July were up by 3.8% from one year ago, the largest year-over-year jump in six years. Moreover, prices have shot up by 9.6% from February, when they registered their lowest levels of the housing downturn, according to CoreLogic CLGX +0.40% data released Tuesday.

This adds evidence to the case that U.S. home prices may have hit bottom earlier this year. Even though prices will soften in the autumn, “we have a much better supply and demand dynamic” than in previous years, said Mark Fleming, chief economist at CoreLogic.

So when people say they believe home prices haven’t reached a bottom—that this year’s seasonal gains will be wiped away by January or February of next year—here’s the relevant question: Will home prices fall by 9.6% in the next six months?

Anything, of course, is possible. Home prices fell in the winter—what Mr. Fleming calls the “offseason”—in each of the last three years to record a new low. But they have not fallen by 9.6% in any six-month span since March 2009, which was when the U.S. economy was still in recession.

That’s the good news. Here’s the bad news: While the year-over-year comparisons look good right now, the economy—and workers’ wages—aren’t growing fast enough to justify this kind of increase on a sustained basis.

Instead, the snapback in home prices in the last six months is more an indication of how prices “over-shot” over the past year. Investors, sensing deals, began buying up homes. The most likely scenario for home prices over the next year is that they may rise, but not at the breakneck pace of the past few months (and they’ll fall on a relative basis in the coming months due to normal seasonal factors).

There are other serious headwinds. It’s still hard to get a mortgage, and many households have too much debt. Millions of homeowners owe more than their homes are worth. Millions more have enough equity to sell their house but not enough to make a down payment on their next house and pay a real-estate broker’s commission.

As we’ve written many times before, the strong rise in home prices this year owes as much to sharp declines in inventory as it does to demand-side improvement. Banks have been much slower to take back and list foreclosed properties, easing pressure on home prices but leaving a bloated “shadow inventory” of potential foreclosures.

These homes will weigh on markets for years, though there’s less evidence that they will be dumped on the market at once. While the shadow inventory may not lead to a big drop in prices that some have feared, it will probably keep a lid on future home-price gains.

Finally, lower mortgage rates have dramatically increased the purchasing power of today’s home buyers when compared to one year ago. Some real-estate executives are nervous that demand isn’t stronger given today’s low mortgage rates, and they’re worried about what will happen if rates rise.

The bottom line: Don’t be surprised if the all-time low in home prices is in the rearview mirror. But this doesn’t mean a full-on recovery is here, and there’s little evidence that the current pace of improvement can continue. For now, home prices appear to be bumping along a bottom.

Follow Nick @NickTimiraos

The first full week of March. Continued low inventory and strong demand has created a dynamic where inventory is selling very quickly, many with multiple offers. Pending home sales increased last month by 44% from last February as per the Massachusetts Association of Realtors. We usually start seeing an increase of market activity in early March culminating in May but this early activity is similar to what we see in a very busy mid spring market. Crazy for the first week in March.

Open houses on the last two Sundays were literally mobbed with 25 – 40 visitors at every open house. Very rarely have we seen 20 parties waiting to get into an open house on Sunday yet this scene was repeated in almost every neighborhood this past weekend.

Open houses on the last two Sundays were literally mobbed with 25 – 40 visitors at every open house. Very rarely have we seen 20 parties waiting to get into an open house on Sunday yet this scene was repeated in almost every neighborhood this past weekend.

While new proprieties are coming on the market they are selling just as quickly . The South End has 21% less condominiums available for sale than at the same time last year. Back Bay has 12% less. Beacon Hill has 41% less. South Boston has 31% less condos for sale then at this time last year.

Our office put 11 properties under agreement in the last 10 days with a volume of $11M, and listed just 10. This is happening all over the city and does not allow for any appreciable and normal build up of inventory heading into the key spring Market. Those properties that went under agreement this weekend were 524 Massachusetts Ave #3, 94 Waltham St # 6 and 343 Commonwealth Ave.

There will be several new properties listed this week that were mentioned “around the table” in my sales meeting yesterday. This activity looks promising and hopefully will begin to build some listing momentum. All are very attractive, well priced properties with prices from $499K and up. Will they stick around long? I will let you know next week.

There will be several new properties listed this week that were mentioned “around the table” in my sales meeting yesterday. This activity looks promising and hopefully will begin to build some listing momentum. All are very attractive, well priced properties with prices from $499K and up. Will they stick around long? I will let you know next week.

I love getting my hands on “hot off the presses” year-end sales results from MLSPIN, the real estate industry’s data platform. I have written in prior posts that the South End and the $1M+ markets in particular have fared well in 2011. Well, the good new continues as we look at initial year-end data.

I love getting my hands on “hot off the presses” year-end sales results from MLSPIN, the real estate industry’s data platform. I have written in prior posts that the South End and the $1M+ markets in particular have fared well in 2011. Well, the good new continues as we look at initial year-end data.

Boston’s core downtown neighborhoods showed strength and resiliency in 2011. As a group of neighborhoods including Back Bay, Midtown, South End, Bay Village, Beacon Hill, Charlestown, Fenway, Seaport, Waterfront and the North End, the median condo sales price in 2011 was $545K, up 1% from 2010. The average condo sales price $769K, was down only 2% year over year. Total sales units were 1727 vs 1707 an increase of 1%. This is an important number as most of the year we had been up against the inflated sales numbers caused by the tax credit through spring 2010. Total core downtown neighborhood sales volume was even with 2010 at $1,329M. (That’s One Billion and three hundred twenty-nine thousand dollars in condo sales.)

When you look at all of Boston neighborhood’s*, including the core downtown neighborhoods and others from Allston/Brighton, Chinatown, South Boston, Dorchester, Roslindale, to W. Roxbury, the average median sale price for condos was $380K which was up 3%. The average sales price was $535K, up 3%.

These preliminary figures reflect a market that remains consistently strong, and resilient. We are extremely fortunate to be living in Boston, and experiencing a relatively strong market where opportunity exists whether you are buying or selling. Boston is a great place to be in 2012.

*MLSPIN groups all these neighborhoods under Boston when doing a general “Boston” search.