February was a strong month for real estate. The Cape was effected by 4 weekend snow storms but Boston buyers scoffed at the weather and added momentum to sales in the New Year.

BY INMAN NEWS, THURSDAY, MARCH 21, 2013.

Housing trends image via Shutterstock.” width=”225″ />

Existing-home sales and prices posted strong year-over-year gains in February, while inventory remained tight but eased slightly, according to a monthly report released today by the National Association of Realtors (NAR).

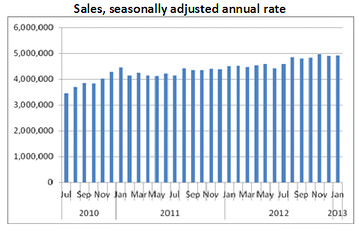

Existing homes, which include single-family, townhomes, condominiums and co-ops, sold at a seasonally adjusted annual rate of 4.98 million during February, up 0.8 percent from January and 10.2 percent from a year ago. That’s the fastest pace of sales since November 2009 when the first-time homebuyer tax credit boosted purchases.

The national median existing-home price remained level at $173,600 from January but was up 11.6 percent from a year ago, continuing a 12-month string of consecutive year-over-year price increases not seen since May 2006.

Existing-home inventory rose 9.6 percent from January to 1.94 million units in February but remained tight, at 19.2 percent below the inventory level from a year ago.

With the month-over-month growth, the months’ supply of inventory — the amount of time it would take to sell all homes now on the market at the current rate of sales — rose to 4.7 months, up from 4.2 months in January.

Some analysts view a six-month supply of homes as a more even balance of buyer and seller demand — anything less than that indicates a seller’s market.

NAR Chief Economist Lawrence Yun said that overall economy is resulting in increased demand, sales and prices. Despite rising prices, however, low mortgage rates are still attracting homebuyers, but tight inventory, he said, will continue to temper the housing turnaround.

“The only headwinds (to a housing a recovery) are limited housing inventory, which varies greatly around the country, and credit conditions that remain too restrictive,” Yun said in a statement.

Source: Calculated Risk blog

Existing homes were on the market for a median of 74 days in February — up from 71 days in January and 24 percent below February 2012’s mark of 97 days.

First-time buyers accounted for 30 percent of purchases, unchanged from January.

Distressed homes accounted for 25 percent of all existing-home sales in February — down from 34 percent in February 2012 but up from January’s mark of 23 percent.

Foreclosures made up 15 percent of February’s existing-home sales and sold for an average of 18 percent below market value, while short sales, which made up 10 percent of February’s sales, sold for 15 percent below market value.

All-cash deals accounted for 32 percent of February’s sales, up from 28 percent in January. Investors accounted for 22 percent of existing-home sales in February.

Existing-home sales, February 2013

| Seasonally adjusted annual rate |

4.98 million |

| % change from February 2012 |

+10.2% |

| % change from January 2013 |

+0.8% |

|

|

| National median price |

$173,600 |

| % change from February 2012 |

+11.6% |

|

|

| Unsold inventory (months’ supply) |

4.7 months |

| Share of all-cash buyers |

32% |

| Share of investor buyers |

22% |

| Share of first-time buyers |

30% |

| Share of distressed sales |

25% |

Source: National Association of Realtors

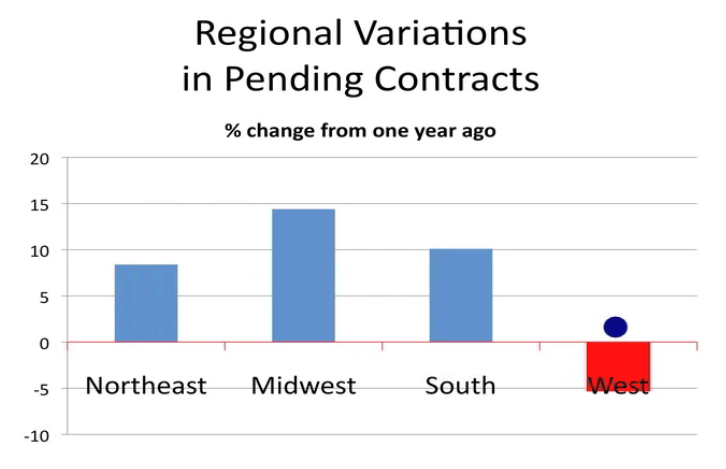

All regions saw year-over-year increases in existing-home sales with the South leading the way with a 14.9 percent jump in sales from a year ago to an annual rate of 2.01 million in February on a median sale price of $150,500.

In the Midwest, sales rose 12.9 percent from a year ago to an annual rate of 1.14 million with a median sale price of $129,900.

Existing-home sales in the Northeast were up 8.6 percent in February, year-over-year, to an annual pace of 630,000 units with a median sale price of $238,800.

The West saw February sales rise 1.7 percent from February 2012 to an annual rate of 1.20 million with extremely tight inventory and multiple bidding raising the median price, year-over-year, 22.7 percent to $237,700.

C7T45ARN5NQSR

The Massachusetts Association of REALTORS® (MAR) reported today that February pending home sales were positive for the 22nd straight month compared to the year before, but winter weather kept gains modest. Pending sales figures (also called homes under agreement) are a leading indicator of actual housing sales in Massachusetts for the following 2-3 months.

The Massachusetts Association of REALTORS® (MAR) reported today that February pending home sales were positive for the 22nd straight month compared to the year before, but winter weather kept gains modest. Pending sales figures (also called homes under agreement) are a leading indicator of actual housing sales in Massachusetts for the following 2-3 months.

Housing trends image via Shutterstock.” width=”225″ />

Housing trends image via Shutterstock.” width=”225″ />